- About Us

- Services

- Industries

- Resource Centre

- Locations

- Contact Us

Financial technology, popularised as FinTech, refers to technology-enabled innovation in financial services. In general, FinTech maybe understood as a broad term that encompasses all the software, mobile applications, and other technologies created to improve and automate traditional usage of finance for businesses and consumers alike. This technological transformation is transforming the financial sector and also the wider economy, affecting all aspects of our work - from payments to monetary policy to financial regulation. The utilisation of smartphones for mobile banking, investing, borrowing services, and cryptocurrency are some examples of technologies designed to make financial services more accessible to the public at large. In FinTech, Artificial intelligence, Blockchain, Cloud computing, and big data are regarded as the "ABCD" (four key areas) of FinTech.

Considering the worldwide scenario, FinTech is one amongst the world’s largest industries. Global investment in financial technology increased more than 12,000% from $930 million in 2008 to $121.6 billion in 2020. The year 2019 saw a record high with the total global investment in financial technology being $215.3 billion, of which Q3 alone accounted for $144.7 billion in investment {Source: "KPMG Pulse of FinTech H1 2021 Global"}. Globally, there were 147 unicorn events round the world for FinTech startups within the year 2021, leaping from 26 unicorn events in 2020. In 2022 YTD, 62 companies became Unicorn. Down by 58% from last year's YTD. Average funding raised by an organisation till it became Unicorn in 2022 (YTD) - $ 179M. Up by 47% from last year. Considering the country-wise scenario for top 5, US leads the way with 171 FinTech Unicorns, followed by China (36), UK (30), India (25), and France (10). In 2022 YTD, 62 companies became Unicorn. Down by 58% from last year's YTD. Average funding raised by a company till it became Unicorn in 2022 (YTD) - $ 179M. Up by 47% from last year. {Source: Tracx}

The scenario regarding the FinTech sector in Australia is no different. The Australian financial sector is the single largest contributor to the national economy. The FinTech sector in Australia has experienced significant growth in recent years. The market in Australia features a diverse range of startups entering many FinTech subsectors across the country. Payments, wallets, and supply chain and lending are the foremost developed FinTech subsectors in Australia in terms of number of businesses, however, that has not limited the expansion of newer, emerging fields like challenger banks or neobanks, blockchain, and insurtech. Australia now ranks 6th in the world and 2nd in the Asia Pacific region, according to global research and analytics firm, Findexable {Source: 2021 Global FinTech Rankings, Findexable, accessed July 2021}. Australia now has more than 850 active FinTech companies, who between them earn $4 billion in revenue a year, according to data from EY. In terms of demography, Australian cities are climbing up the ladder as a global FinTech hub. Now Sydney comes in at 11th place in the city rankings, while Melbourne is placed 25th. Additionally, for the first time Brisbane broke into the Top 100 and is placed at 98th position. {Source: https://www.austrade.gov.au/} Few examples of startups selected from different subsectors of FinTech include Brighte (Provider of payment facility solution in the solar financing segment), Athena (Online mortgage platform for home loans), Till Payments (Blockchain-based payment solutions for businesses), Stake (Online platform for trading in stocks and ETFs), and Karbon (Cloud-based workflow management software for accountants).

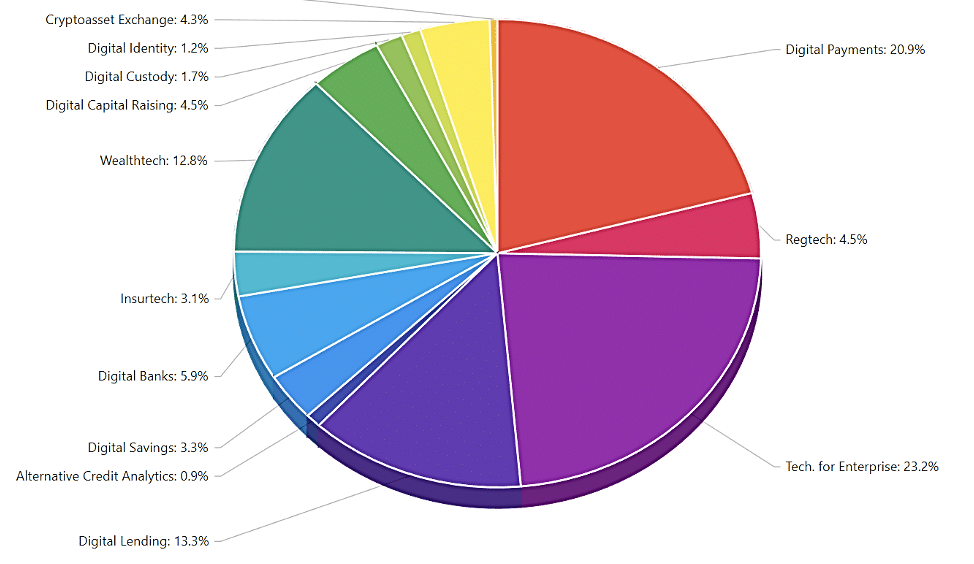

The pie chart below illustrates the FinTech Australia Ecosystem Map based on different subsectors of FinTech {https://ecosystem.FinTechaustralia.org.au/}:

It is pertinent to notice that the challenges of the pandemic have accelerated the adoption of FinTech products and services, and provided the foundation for consumers to assess their options and experiment with alternative financial services solutions. In fact, the number of Australian FinTech businesses have more than doubled between 2017 and 2021.

Where there is technology and innovation, the it inevitably leads the conversation to patent. Patents give the applicant a monopoly on the use of their technology and thus give a startup or any organisation a huge boost in creating their market. Patents not only keep out competition, but also encourage people to keep innovating. In addition, the patent rights are also a tool for potential investors who then feel more confident about the uniqueness of the concept and security from technology theft.

Therefore, in the ever-growing FinTech market, a patent can be a very important tool to maximise the commercial value and establish protection for investment in an innovation. It may turn out to be the difference between a successful startup and an unsuccessful one, as every company needs a USP to withstand market conditions and competition. A patent in many instances is that USP.

However, the patentability of FinTech innovations have always been complex in many jurisdictions. Although the criteria may be different between various countries, in order to patent something it is essential that it consists of patentable subject matter and it should not fall under subject matter explicitly excluded from the scope of patentability. For example, in the US, certain subject matteris considered as “Abstract idea” which are excluded from the scope of patentability, as mentioned in 35 U.S.C. 103. Similarly, Section 3 of Indian Patents Act, lists out the non-patentable subject matter. But still, the laws in US may be considered slightly broader and accepting, as they enable business methods and computer related inventions (both of which form the crux of a FinTech-based innovation) to be patented, provided that they pass the tests set-forth for checking the patentability of subject matter. In Australia, there are no specific exclusions for software or methods that are implemented as computer software or a related product, however, these inventions are only patentable if what is claimed is not a mere scheme, abstract idea or mere information.

Unsurprisingly, the US tops the patent filings in FinTech sector. It is evidenced by more than 5,000 patents and published applications in the U.S. during the last decade. Many banks and FinTech startups are racing to create their patent portfolios by acquiring disruptive technologies in the blockchain and payments subsectors as financial institutions and banks quickly understand the role of intellectual property in their business and monetisation strategies. In 2018, electronic/mobile banking and financial security technologies accounted for the majority of the nearly 4,000 FinTech patent applications held by some of the biggest organizations in the technology and financial industry, such as Bank of America, Google, IBM and Visa. The increase in cryptocurrency and blockchain patents has enabled many new FinTech startups and global FinTech hubs to emerge. Many startups use business and competitive intelligence to develop a patent portfolio around FinTech stock and commodity trading, cryptocurrency mining, and blockchain-implemented financial security protocols that address the complex financial regulatory landscape.

Similarly in Australia, the criteria for patentability involves that the invention must meet at least one of the following requirements:

• The contribution of the invention must be technical in nature.

• The invention must solve a technical problem within the computer.

• The invention requires more than just generic computer implementation.

• The computer must add something more than just being an intermediary tool.

• The ingenuity of the invention must not solely relate to the scheme.

From the perspective of FinTech Innovations that generally involve financial processes or systems applied to a computer, it can be established that there must be a technological improvement in the way the computer operates. More specifically, it may be inferred that making a financial process or system more efficient or cost effective may be considered as an improvement to a non-patentable subject matter, and therefore may not qualify as a patentable technological improvement. However, still there are patents granted in Australia for all kinds of FinTech innovations staring from Insurance applications, mobile banking apps, online payment portals up to blockchain and cryptocurrency.

Developing a strong FinTech patent portfolio is difficult but not impossible. The patentability of FinTech innovations still remains complex with the requirement that any claimed invention meets the requirements for a manner of manufacture within meaning of s 18(1A)(a) of Patents Act 1990. subjective.Getting a patent application granted or rejected by the Australian Patent Office might ultimately come down to the down to the skills of the Patent attorney and how he/she frames the new process or system in the patent application to highlight the technological advancement of the innovation. The advantages that come along with a patent, such as value addition, fostering innovation, and providing a strong defence can be worth the time and money spent on developing a strong patent portfolio. Having the right patent portfolio in place ensures that the valuable FinTech ideas are secure, while staying one step ahead of the competition. Failure to do so, may open the door for the competition to barge in and profit off someone else’s efforts. Having no patents provides no barrier to entry to the market in which you are playing, having a patent application or granted patent can at least provide some protection.

If you have a FinTech-based invention and have any questions about filing a patent application, contact our expert attorneys at IP Guardian for an obligation free consultation. Our attorneys are experts and can assist you in protecting your Intellectual Property.

Registered Patent and Trade Mark Attorney with significant experience obtaining all forms of registered intellectual property. I hold a Bachelor of Science in Engineering, a Masters of Business Administration and a Masters of Intellectual Property. I’m passionate about showing my clients how they can protect their brands through trademark registrations.

I found them online and initially I was bit hesitant to talk to them about my problem but when I spoke to Barry, I felt more comfortable, and he gave me all the information and advice I wanted without even thinking that I am going to give him business or not. Finally, I went with them, and they made the entire process so smooth and easy for me. john was keeping us updated with each step he was doing. I would recommend these guys for any patent or trademark related service.

I would like to express my thanks to Barry and his team at IP Guardian in Sydney for their assistance with our recent Trademark application. Barry was highly professional, readily available throughout the process and clearly communicated expectations. Barry even helped us refine our application so that we had a greater chance of success which was very much appreciated to avoid extra costs. I would highly recommend Ip Guardian for all your Trademark and Intellectual Property needs.

Barry, last week, you and your professional team, made my year (or probably my next 21 years). So thank you so much for your executive, calm yet very effective actions under extream pressure. Elias Hajjar, Director, TROLLEYON PTY LTD

Informative, understood the business, what it needed and answered questions in a friendly and approachable manner. Easy decision to continue working with IPGuardian for future trademarking

From the day I contacted Barry Meskin until now with my silly amateur questions, he has been nothing short of amazing. I actually NEVER leave reviews anywhere, but I felt the need to do so for Barry and his team. I myself am a tradie, so I felt intimidated speaking to an attorney. But the second I spoke to him on the phone, he made me feel right at home. Never pressured me into any decisions, yet when I decided to go ahead with him, he delivered what I needed much quicker than what I was expecting. I cannot speak highly enough of him and recommend his services 100%.

The team at IP Guardian have made the process extremely straight forward and easy for us to understand exactly what was required. I will highly recommend to our clients who need help with IP.

I have dealt with Barry over the years, his advice and experience has helped me greatly. Looking for to working with him and his team again. Maher.

IP Guardian helps protect words, symbols, letters, numbers, names, signatures, phrases, sounds, shapes and smells. Yes, I said smells.

We've had the pleasure to work closely with Barry for many years. He has been exceptional to deal with and has a keen focus in providing a commercial led IP "go to market" strategy for start-ups and well known brands. Makes it easy and always advises on different ways to navigate through the IP process.

Barry Meskin @ IP Guardian is an experienced and extremely knowledgeable expert in the domain of intellectual property, patents and trademarks. In addition he has been extremely responsive and very professional in all our dealings. I wholeheartedly recommend Barry's services to any business or anyone seeking advice in this area - great quality and great value.